Republican Tax Law is Hurting Wisconsin Communities

The Republican Tax Law prioritizes handouts to big corporations and the ultra-wealthy over relief for working families, seniors, and small businesses here in Wisconsin. After gaining a majority in both houses of Congress in 2016, Republicans moved forward with their top priority: passing the Republican Tax Law. The law helped those at the top avoid paying their fair share while failing to prioritize everyday people and putting funding for programs like Medicare and Social Security at risk.

Many of the provisions in the Republican Tax Law expire at the end of 2025, giving us a chance to create a fair tax code that supports working families, small businesses, and seniors. But, Republicans would rather extend the tax policies – and are even trying to give more tax handouts to corporations and the ultra-wealthy. Extending the Republican Tax Law will make the wealthy even wealthier and continue rewarding big corporations for their price gouging, while threatening the programs everyday Wisconsinites count on, like Social Security and Medicare.

What is the Republican Tax Law?

In 2017, the Republican-controlled Congress passed a massive tax package that disproportionately delivered tax breaks to the wealthy and corporations. Not a single Democratic member of Congress voted for the law.

What were the main provisions of the Republican Tax Law?

For several decades, the top tax rate for corporations was 35%. The Republican Tax Law lowered that rate to 21% and has even allowed some big corporations to pay even less than that. This tax cut primarily benefits the wealthy owners of these companies, as well as top executives – instead of benefiting everyday Americans who need the help the most.

Who benefited from the Republican Tax Law?

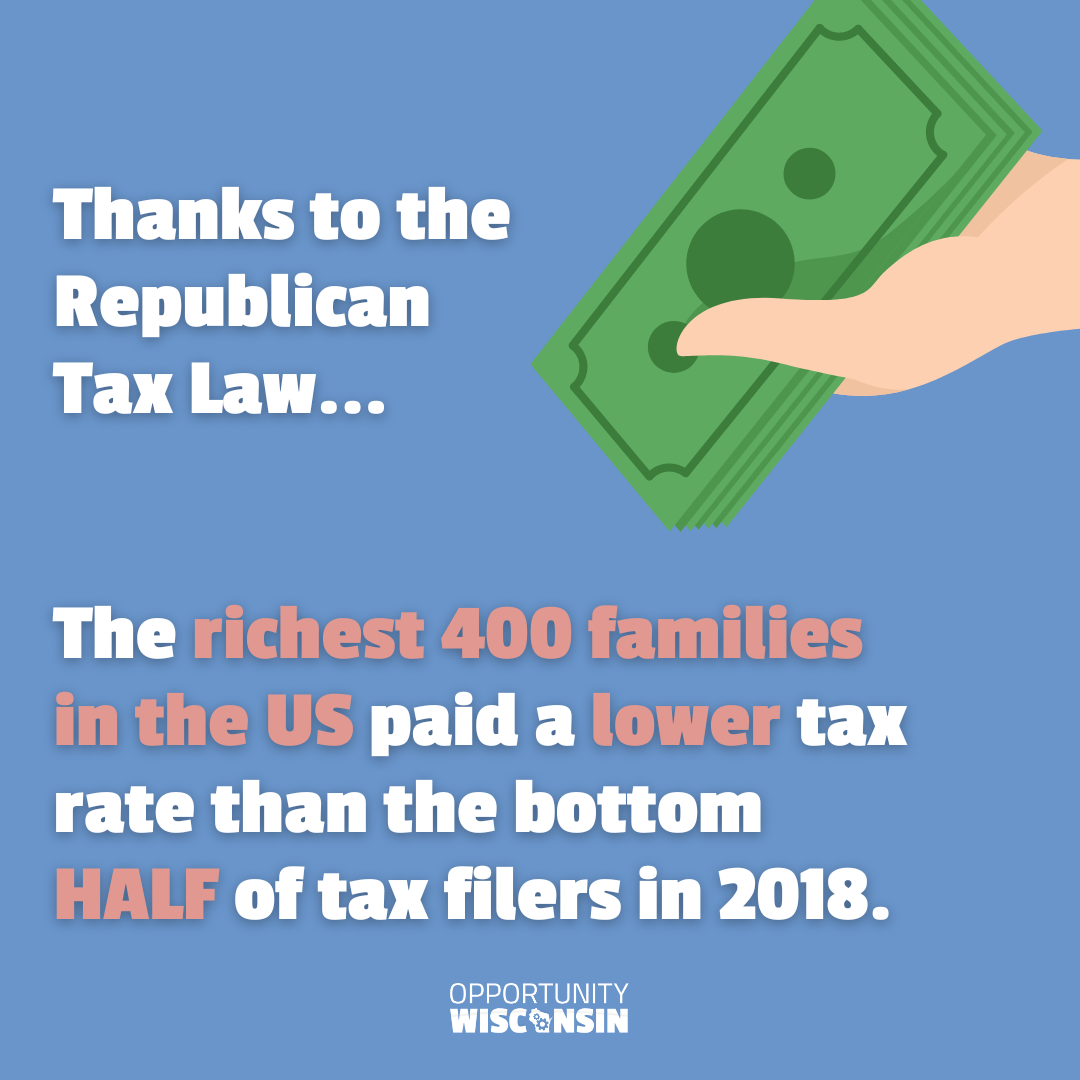

The top 1% and big corporations were the primary beneficiaries of the Republican Tax Law. In 2020, the richest 1% of Wisconsinites got 24% of the total benefit from the Republican Tax Law, compared to just 10% for the middle 20%.

Many wealthy corporations also received massive tax cuts. These companies have largely used their tax cuts to benefit wealthy shareholders, rather than raise wages or lower prices.

Why are we talking about this law so much, 7 years after it was enacted?

When the Republican Tax Law was passed, many of its provisions were set to expire after 2025. Now, the clock is winding down, and extending the law will continue to rig the rules in the favor of corporations and the top 1%.

This creates an opportunity for a real discussion over how to improve the tax code next year – and the chance to pass new policies that support working families instead of prioritizing those at the top.

What happens if Congress just extends the GOP Tax Law?

If Congress extends the Republican Tax Law, it would be both unfair to everyday Wisconsinites and extremely expensive. Extending the law would cost about $4.5 trillion, with most of the benefit going to people making more than $400,000 a year.

What would a better tax code look like?

Instead of giving yet another tax cut to the top 1%, we need a tax code that makes corporations and the wealthiest of the wealthy pay their fair share, while also giving everyday Wisconsinites the tools and resources they need to help get ahead.