FOR IMMEDIATE RELEASE

WEDNESDAY, JANUARY 21, 2026

CONTACT: press@opportunitywisconsin.org

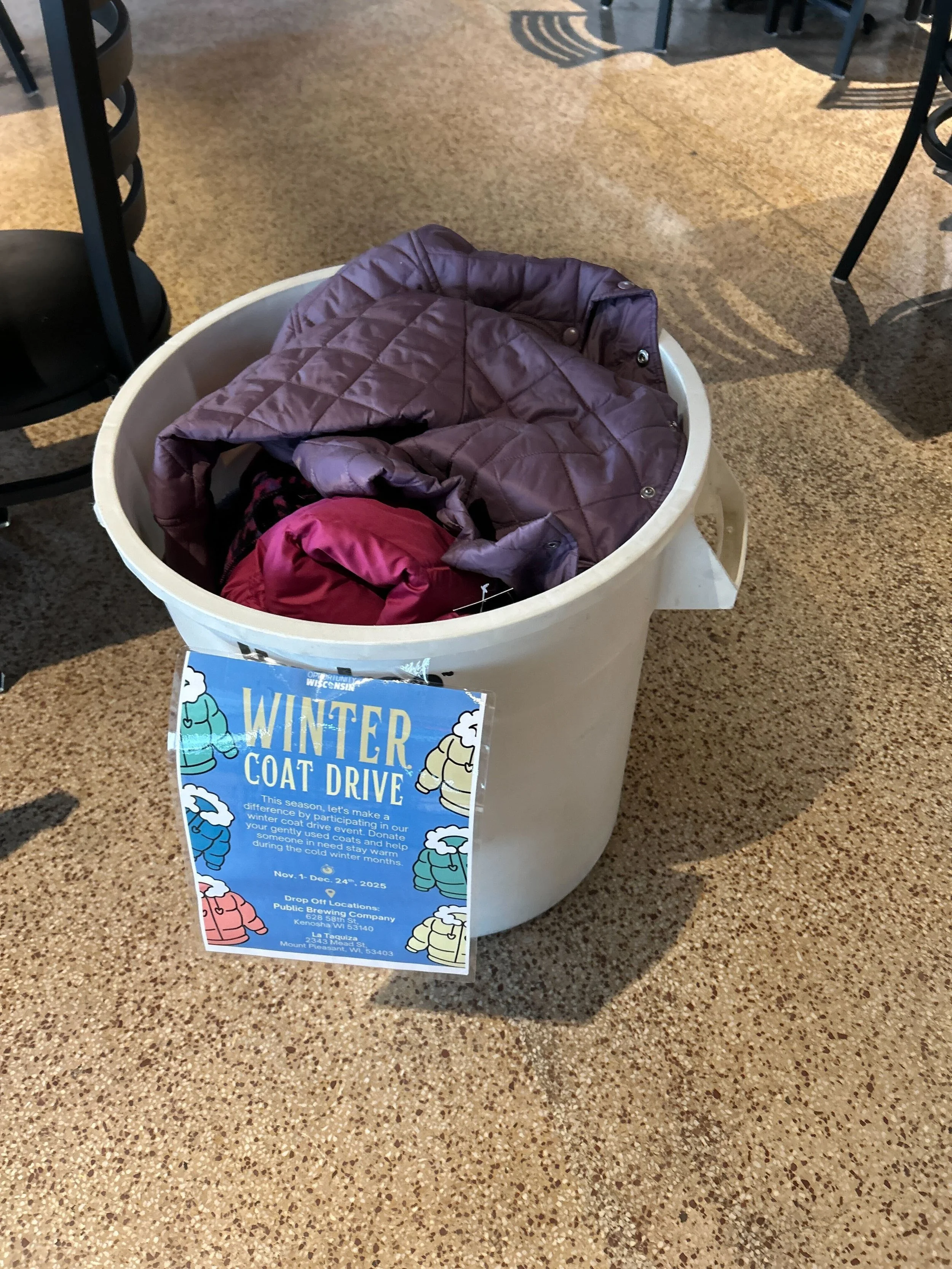

Opportunity Wisconsin wraps up winter coat drive, collecting nearly 100 coats for local nonprofits

As families face high costs and tight budgets, Opportunity Wisconsin and local businesses step up to help community members in need

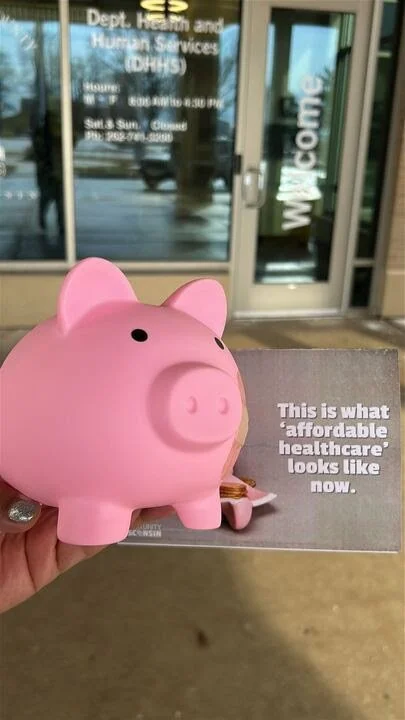

MADISON, Wis. – Opportunity Wisconsin and local businesses across the state wrapped up their "Don't Leave Wisconsinites Out In the Cold Coat Drive,” collecting nearly 100 coats for Wisconsin families struggling with rising costs thanks to tariffs, increasing healthcare premiums, and other policies that are making essential items unaffordable for too many families.

The coat drive partnered with local businesses across the state including Eau Claire Outdoors in Eau Claire, Public Brewing Company in Kenosha, and La Taquiza restaurant in Mount Pleasant. Collected coats are being distributed to families in need through local nonprofit organizations.

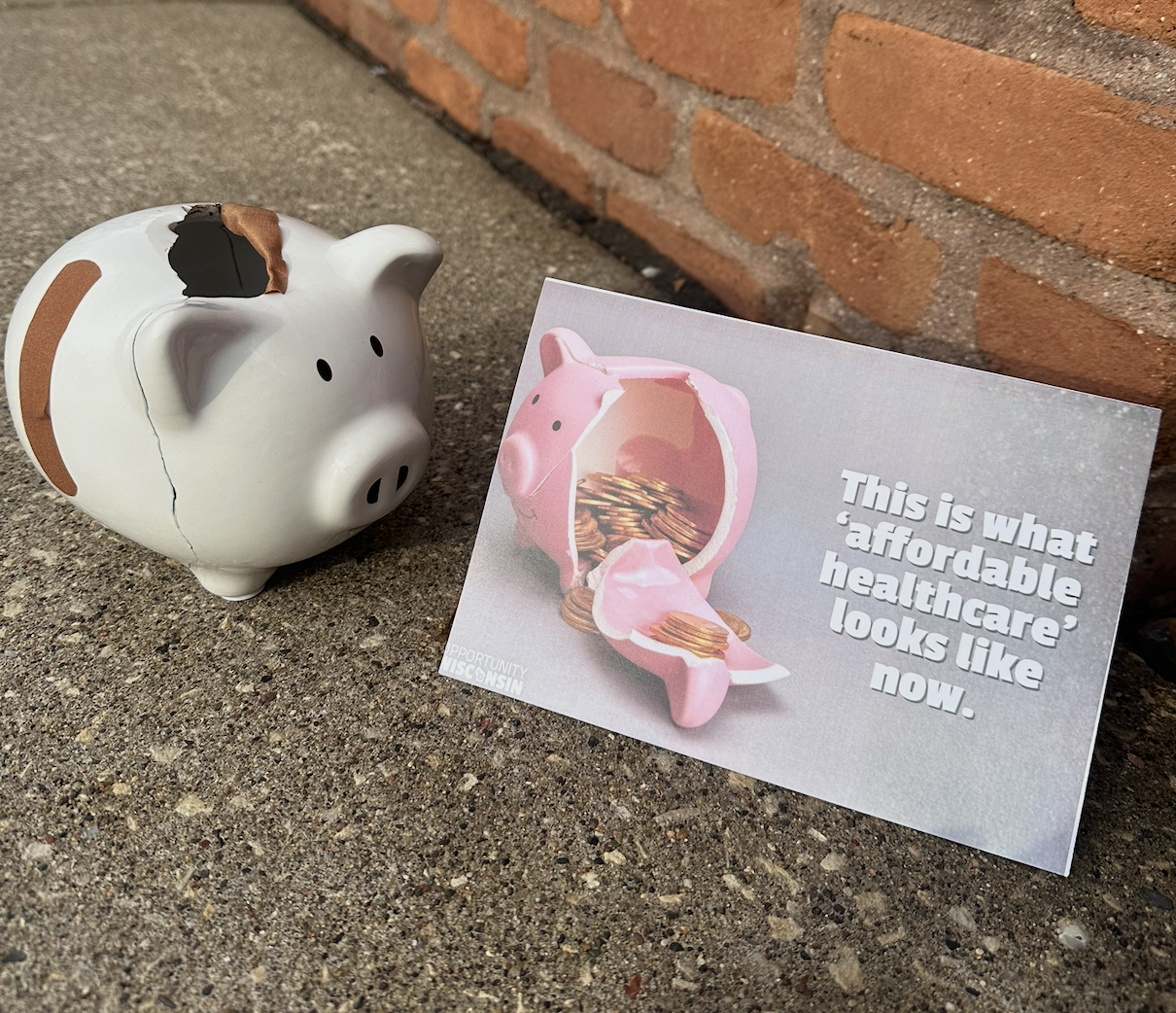

"The overwhelming response to this coat drive shows what we already know—Wisconsinites take care of each other," said Opportunity Wisconsin Program Director Meghan Roh. "But community generosity shouldn't have to make up for failed policies in Washington. We need leaders who will fight to lower costs for working families, not add to their burden with cuts to critical programs."

"We were proud to be part of this effort," said Emanuel Davalos from La Taquiza. "Our community showed up in a big way, and it's been incredible to see so many people come together to help their neighbors. Every coat donated means a family stays a little warmer this winter."

"Supporting our community is what we're all about," said Kate Felton from Eau Claire Outdoors. "This coat drive reminded us that when people work together, we can make a real difference for families who need it most. We're grateful to everyone who donated."

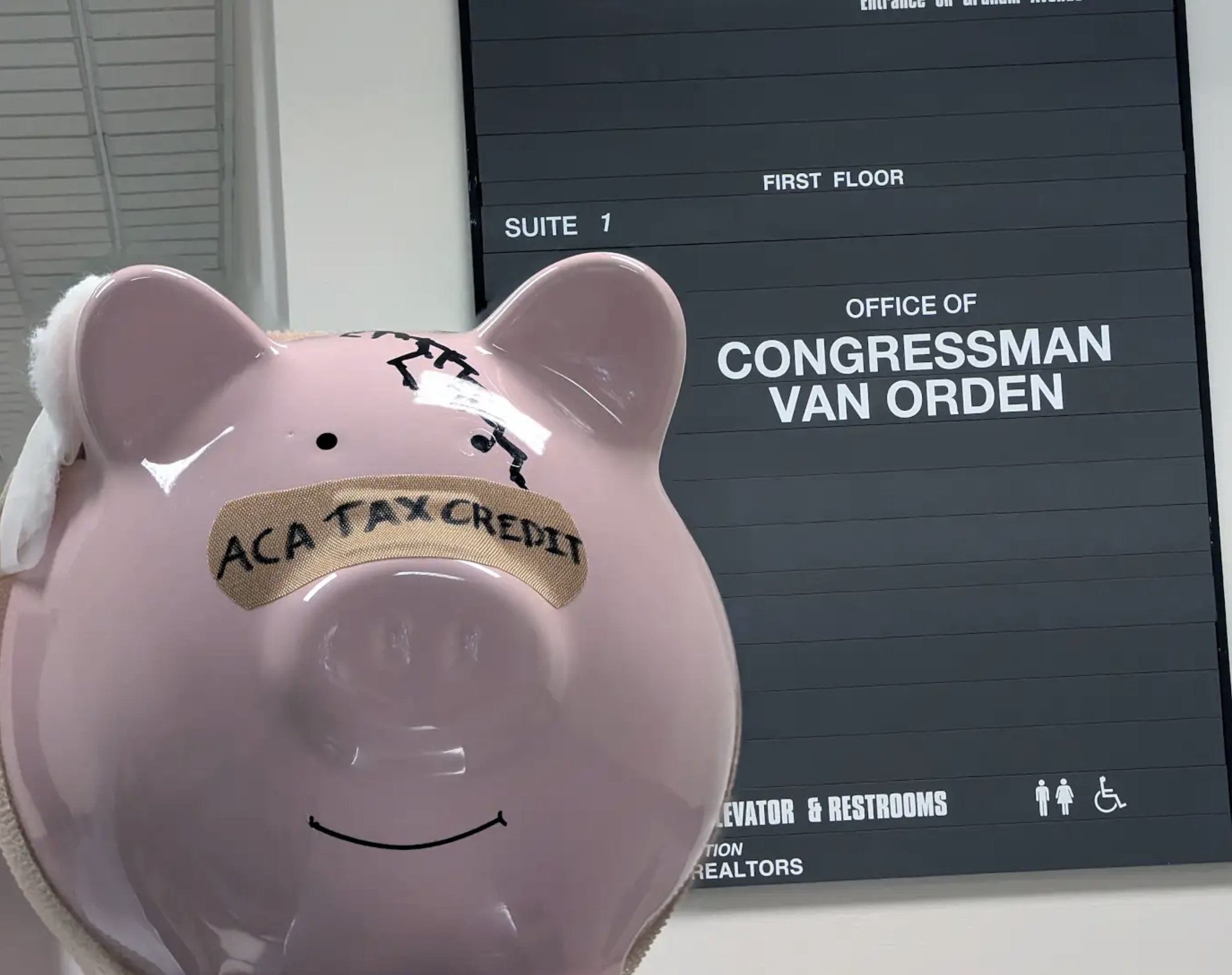

In the coming weeks and months, members of Congress including Congressmen Bryan Steil and Derrick Van Orden have the opportunity to lower costs and ease the burden on Wisconsin families. Whether it’s restoring health care tax credits to make premiums affordable or repealing costly tariffs that are driving up the price of everyday items, it’s critical that Congress prioritizes relief for working families who are struggling to succeed.

###