FOR IMMEDIATE RELEASE

MONDAY, DECEMBER 22, 2025

CONTACT: press@opportunitywisconsin.org

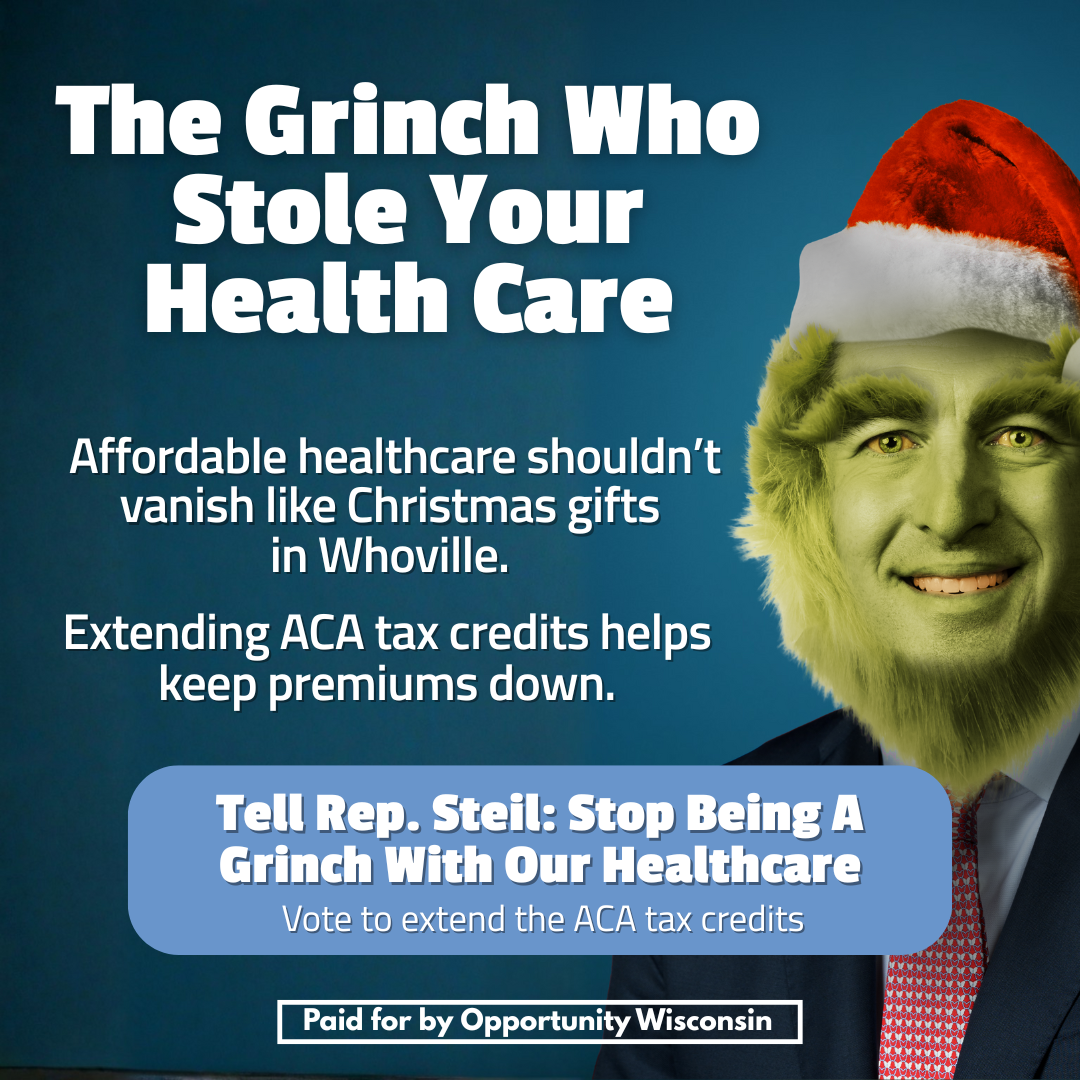

The Grinch Who Stole Your Healthcare: New digital ads highlight Reps. Steil and Van Orden’s refusal to extend health care tax credits

New ad campaign launches as Wisconsin families are set to see premiums more than double in 2026

MADISON, Wis. – Opportunity Wisconsin has launched a new holiday-themed digital ad campaign in the 1st and 3rd Congressional Districts to highlight Congressmen Bryan Steil and Derrick Van Orden’s refusal to extend health care tax credits.

By refusing to extend health care tax credits, Steil and Van Orden are standing by while premiums more than double for tens of thousands of Wisconsin families at the start of the new year, which will force many to go without the care they need. Congress is running out of time to take action.

Thanks to bipartisan support, a discharge petition will force a vote on a three-year extension of these cost-saving tax credits. Last week, Steil and Van Orden voted for a Republican health care bill which failed to include an extension of the tax credits. Analysis of their proposal also shows it will actually raise rates and jeopardize access to care.

“Working families are being hit hard enough this holiday season. Costly tariffs are driving prices through the roof and economic uncertainty is making it harder to put presents under the tree and food on the table. Now, if Republicans like Congressmen Bryan Steil and Derrick Van Orden refuse to act, many Wisconsinites will watch health care costs more than double in the new year,” said Opportunity Wisconsin Program Director Meghan Roh. “Steil and Van Orden don’t need to be Grinches – they need to support a three-year extension of health care tax credits and make the holidays a bit brighter for their constituents. It’s time for them to act before it’s too late.”

Opportunity Wisconsin’s new digital ads are part of a four-figure media campaign through the holiday season. These ads are in addition to a previously-launched seven-figure ad campaign in the 1st Congressional District to highlight Steil’s support for policies that are driving up everyday costs.